The application process to own a great 401(k) loan comes to contacting your employer’s senior years plan administrator or the economic establishment controlling the 401(k) package. Fundamentally, you can easily submit financing papers and you may establish the total amount you would like so you’re able to obtain, pursuing the 401(k) plan’s advice.

Approval to have a great 401(k) financing will not cover borrowing from the bank monitors. For this reason, the procedure is usually easy, towards amount borrowed dependent on the vested 401(k) harmony.

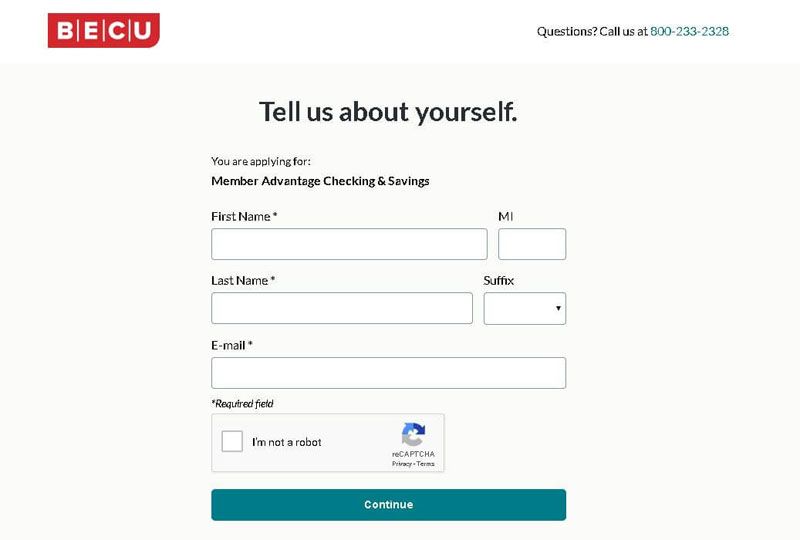

In contrast, the application form techniques to have a good HELOC initiate by making use of that have a good lender, tend to a bank otherwise a card relationship. Lenders essentially determine your credit rating, money, value of, or other points to know if you meet the requirements.

If your bank establishes you’re pre-qualified for a beneficial HELOC, property appraisal may be needed to confirm the value of your property. The applying and you will recognition processes usually takes much longer than a beneficial 401(k) financing due to HELOCs aren’t demanding an extensive borrowing from the bank assessment and assets testing.

Why does possibly solution affect my personal credit history?

Good 401(k) financing will not feeling your credit score because it will not involve a great credit score assessment. The borrowed funds is taken from your own later years savings, and its payment otherwise non-fees doesn’t get said so you’re able to credit agencies. So, it will not apply at your credit score positively otherwise adversely.

Having said that, an excellent HELOC can impact your credit rating. Applying for a HELOC may cause a challenging inquiry into your credit score, that can cause a slight, short term reduced total of your credit score.

For individuals who maximum your HELOC borrowing limit, it can cause one to read the article features a high borrowing from the bank usage ratio, probably affecting your credit rating negatively. However, punctual and you will consistent payments into HELOC can be definitely determine their credit history over the years.

Have there been limitations precisely how I will make use of the funds from a beneficial 401(k) financing or HELOC?

The manner in which you plan to make use of the financing loans could affect your own capacity to rating a beneficial 401(k) mortgage or HELOC as well as the fees terminology. Such as for example, when you use the income away from an effective 401(k) financing to buy your no. 1 house, you might be capable pay off the loan in more than the standard restriction of 5 decades.

For every HELOC financial will set its own legislation and you will limitations toward the best way to utilize the financing fund. Of several loan providers never place people limitations about how you utilize this new finance. But, it is necessary to use the loans responsibly once the you will have to repay the amount your acquire having notice.

How does the economical ecosystem connect with HELOC rates of interest otherwise 401(k) financing terms?

The economical environment can rather apply to HELOC rates and you will 401(k) loan terms and conditions. Financial gains will happens when interest rates is lower. It’s less costly to borrow funds throughout these attacks, definition discover lower HELOC pricing and much more positive 401(k) mortgage terms and conditions.

On the other hand, interest rates tend to be highest while in the slow economic environment, and it’s more costly to borrow money. These types of periods are designated because of the higher HELOC prices and less advantageous 401(k) financing terminology.

- Inflation: Rising cost of living is the rate from which charges for products or services is ascending. Whenever inflation is actually large, it does rot the worth of money, and work out individuals quicker prepared to borrow funds. This can lead to higher rates.

- Unemployment: Unemployment is the portion of people who find themselves earnestly trying to find work but they are unable to get a hold of employment. When jobless are high, it can end up in down consumer spending, that will along with result in lower rates.

- Gross domestic tool (GDP): GDP is the total worth of goods and services produced in a country in certain season. Whenever GDP continues to grow, they means new economy are broadening, which can lead to all the way down interest rates.