How foreclosure process and you will brief deals processes connect with people like you

Whenever you are in the market for a home however, selecting an effective way to save money on which major purchase, you might be provided to shop for a foreclosures otherwise a primary selling. Navigating the new small deals procedure and also the property foreclosure techniques can be a little tricky as a result of the paperwork on it. Since the house’s current owner is actually a hard financial situation, there’ll be additional steps in the borrowed funds process. But, if you use an agent proficient in this type of version of deals, buying one of them characteristics can depict good savings. Find out the variations when buying a short deals vs. a foreclosure so you’re able to anticipate to browse the procedure.

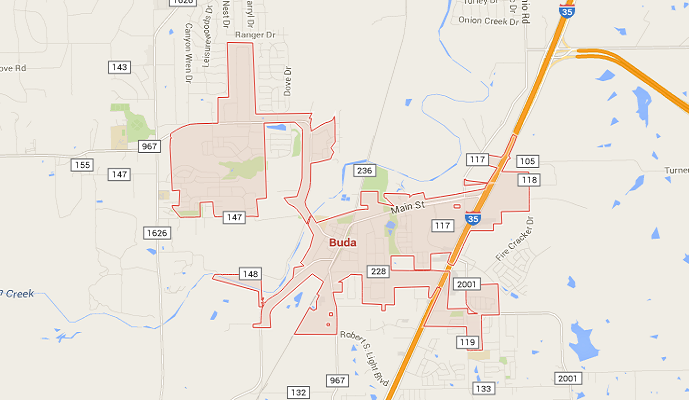

The brand new brief selling processes starts in the event that newest holder recognizes the guy or she will not be able to pay back the loan in the complete. The property owner upcoming negotiates together with or her bank to simply accept a diminished rate into the house. This is exactly a state named pre-property foreclosure. You can begin shopping for homes inside pre-property foreclosure on the internet, in public areas facts or by the coping with a realtor who is experienced in the fresh brief income techniques.

Always tour the brand new available services just as you’d if perhaps you were to shop for a home that has been maybe not a short deals. Nowadays, additionally, you will would like to get your own financial pre-recognition in check to ensure that you will be willing to fill in an offer once you come across a house you are interested in to invest in.

As the owner accepts the bring, the lending company needs to come across proof of financial hardship in the most recent manager so you can commit to an initial sale. Owner usually complete what is actually labeled as a difficulty letter you to definitely lines each of their money to support brand new allege that he or she can’t afford to pay the essential difference between their render as well as the full value of the home. The lender also want to see bank comments and other files support that it claim.

Should your bank agrees in order to stick to the brief purchases procedure, it is possible to complete the lender’s papers, proving that you have your financing under control, the latest serious money on hand and a downpayment. You’ll need even more serious money otherwise a bigger deposit for a primary sale than just you’d to own a low-small income. (Just like the latest manager turned out to be a cards risk, the lender will to own a buyer that have way less risk.)

Up coming, you’re going to http://www.availableloan.net/installment-loans-oh/fresno/ have to wait a little for this files to acquire canned. Generally speaking, small conversion process just take period to closepare that it with the conventional processes, where you could close in two weeks. Some lenders might have small sales committees or at least of many interior steps. So, be patient and sometimes register for the way to end up being yes things are proceeding effortlessly.

To order a property foreclosure property

The new foreclosure procedure for the a property is brought about when a debtor indeed defaults toward loan, definition brand new debtor comes to an end purchasing his or her month-to-month home loan statement. In comparison, brief sales takes place before that time. Usually, the foreclosures procedure initiate three to six weeks pursuing the earliest overlooked mortgage repayment. Once the family goes into foreclosure, the house or property is put up to have public auction from the lender.

Generally speaking, the current financial tend to find the assets during the auction then place it on the market while the-was. So far, the house is named a bona fide house had assets, otherwise REO. To obtain an excellent foreclosed assets, inquire the lending company having a summary of REO characteristics. Purchasing the domestic right from brand new public auction actually usually recommended to own a few explanations. For one thing, newbie buyers will overbid because they are not used to the brand new public auction processes. Next, the latest house’s most recent holder is probably still living truth be told there, and you may eviction process would need to begin.

That is why it is best to sort out the fresh new lender’s set of REO properties. After you choose one you’re interested in to find, work through the lending company to submit a home loan software. Keep in mind that since these services are sold since-was, you should be ready to manage one thing home that won’t getting repaired or upgraded just before your purchase.

Work at a talented realtor through the foreclosure and short sales process

Navigating new property foreclosure or small selling procedure are going to be a challenging activity to your amateur. When you are what was social, recording they down ranging from lenders, criminal background, and you can agencies are a number of performs. As well, it is vital which you follow due dates and you can follow through vigilantly towards the files. Shed one step you are going to delay your application.

You should use a talented broker not to ever merely make it easier to do the process but also render advice. Including, during the early level, they can counsel you toward putting in an offer which is sensible. Be informed one putting in a bid within these belongings would be competitive.

Learn more about to shop for an initial purchases versus. foreclosure assets

The whole process of to purchase a primary revenue or foreclosed home is book every time, therefore you are going to possess a number of concerns. Be sure to work directly having a residents Bank mortgage coach so you comprehend the processes every step of one’s method. Just call 1-888-514-2300 to begin with, otherwise find out about various Owners financial alternatives.